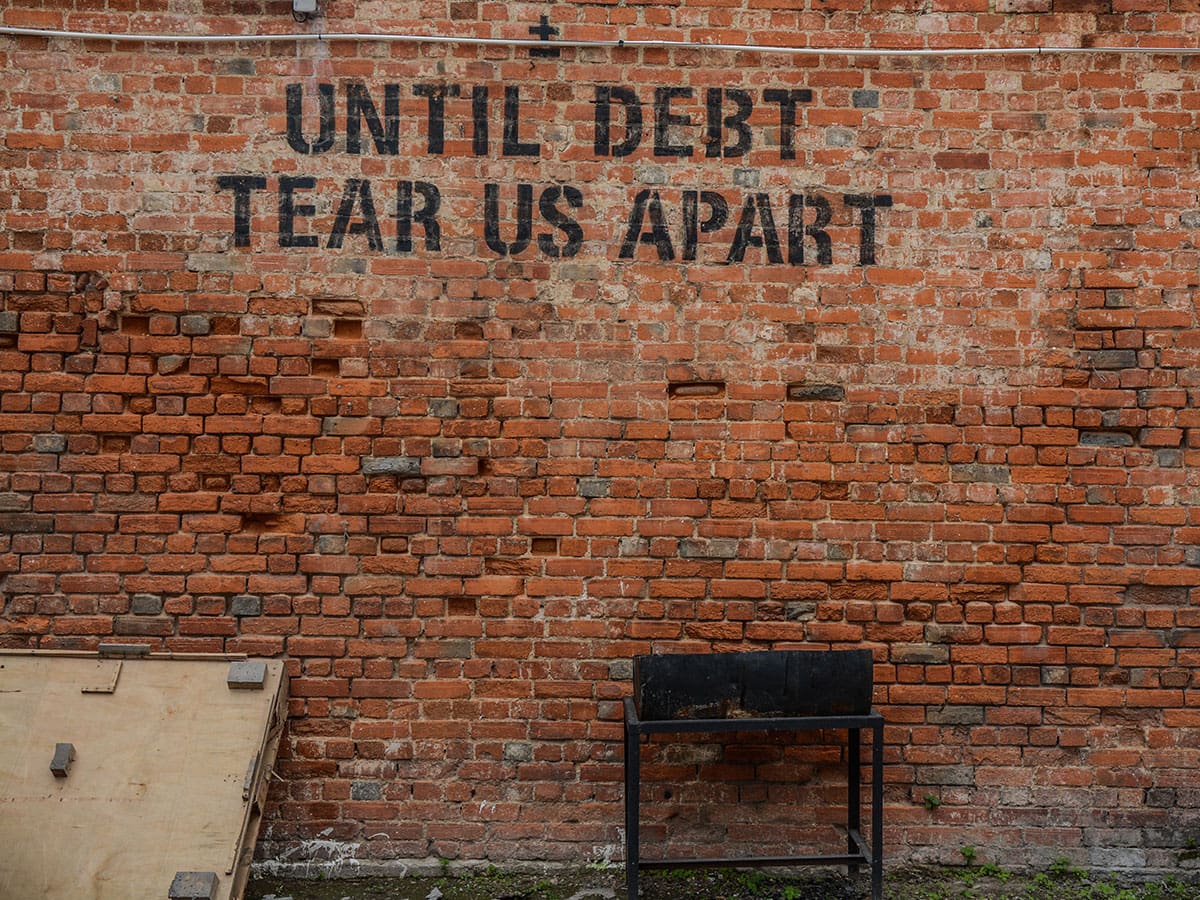

Are we in a recession? How bad are unemployment rates? And how will we pay back our ever-growing coronavirus debt?

These are uncertain economic times. And we have many unanswered questions. Every day, we all try our best to keep up with the day’s breaking news, or latest announcements. But it’s hard to see the wood for the trees.

So this week, the team here at Cobra try to answer your burning financial questions. As simply as we can.

How much money has the UK spent on tackling coronavirus?

The figure is growing by the day, but according to the Office for Budget Responsibility (OBR), it’s likely the UK government will spend around £300bn between April 2020 – April 2021. That’s 5 times more than they were expected to borrow over the same time period. However, this figure could be considerably higher. Especially if there is a second wave of the virus.

How long will it take to pay back?

The Chancellor, Mr Rishi Sunak, warned the UK will enter ‘a very significant recession.’ And it’s estimated it could take decades to pay-off the government’s coronavirus debt.

What’s the true state of the economy?

Well, currently not as bad as first predicted. The Bank of England has said the economic slump will be less severe, shrinking by 9.5%. A much more positive figure than the 14% contraction initially predicted.

This is partly down to the faster easing of lockdown restrictions. Although we’re spending more on household bills than before lockdown, decreased leisure spending will have an impact on the recovery for many months to come.

However, being realistic, this is still the biggest yearly economic decline in 100 years.

Who’ll foot the bill for the government’s spending?

We simply don’t know yet. But we do know that consumer spending is an integral part of the government’s recovery action plan. They want any accumulated lockdown savings to be pumped back into the economy.

However, The Bank of England has announced that average earnings are expected to shrink, meaning more workers will face a pay freeze or cut. And we know that for many, bonuses and commissions have been withdrawn for 2020.

Increase borrowing, raise taxes and cut spending – it seems likely the government will consider all of these options in the months and years ahead.

But it’s not all doom and gloom. It’s widely thought that the Bank will keep interest rates at 0.1% or below, to ensure affordable lending is available to those individuals and businesses who need it the most.

What is the current unemployment rate in the UK?

Unemployment is expected to double by the end of the year to 7.5%.

With the furlough scheme coming to an end, this is an uncertain time for many. Every day, we’re all too aware of the next huge company to announce job losses. Earlier this week, hotel giants LGH told over 1,500 staff they are at risk of redundancy.

Can I get 50% off if I eat out?

If you’re eating at a Eat Out to Help Out registered restaurant in August, then yes: you can get 50% off your food bill. Including non-alcoholic drinks. But it’s not just restaurants and chains taking part; cafes, bars, pubs, canteens and food halls can all register. You can only access the scheme Monday to Wednesday, and pre-booking is advisable. Just type in your postcode here to find out where you can eat with 50% off.

I’m struggling financially. What can I do?

There are so many debt advice services out there. Citizens Advice, Step Change and National Debtline all offer free, confidential support to anyone struggling with debt or their general finances. If you are worried about your situation, then reach out and get help.

My client is refusing to pay me. What can I do?

If you are owed money, and you know your client can pay, then contact Cobra Financial Solutions today. We will visit your debtor within 48 hours of receiving instruction, to get your money back in your pocket. Where it belongs.

Through our enhanced vetting process, we’ll be able to confirm whether or not your client has the means to pay. And we’ll only take cases we know we can win.

We’ve been approached by so many customers lately, each reporting poor behaviour from debtors. Debtors who are using coronavirus as an excuse for non-payment. It seems as though they think their debt will be forgotten: lost amidst the chaos of all things COVID. Breaking news: debtors cannot use coronavirus as an excuse.

If you’d like some advice and information about how we can support you, call us on 0151 526 4222.