Services including the likes of PayPal, Clearpay, Laybuy and Klarna enable customers to either delay the bill for their chosen purchase or stagger it over several smaller instalments.

Sounds good, doesn’t it? However, while the ‘buy now, pay later’ industry has quadrupled in the last eighteen months and is now worth a staggering £2.7bn, so too has the number of people reportedly in debt.

So, with this in mind, we thought we’d investigate further.

BNPL EASY AVAILABILITY

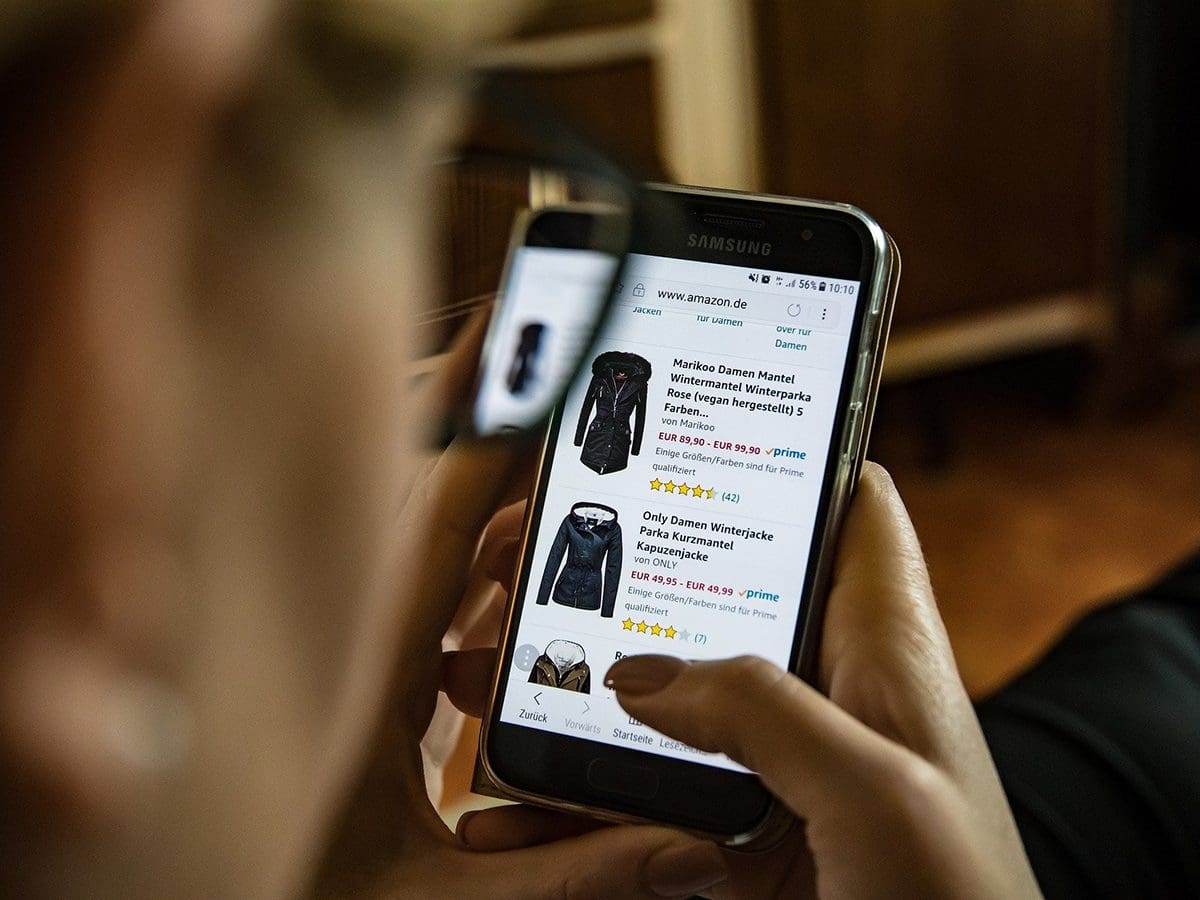

An estimated 5 million people in the UK have bought an item using some sort of ‘buy now, pay later’ scheme; that figure also increased dramatically during the pandemic. But why, therefore, is it so easy to amass so much debt?

The likes of Klarna and PayPal, for example, are not required to perform affordability checks on customers because the sector isn’t regulated by the FCA. Indeed, the easy availability of this type of credit makes these services seem less like a new way to avoid debt and more like a way to kick debt down the road and, in turn, acquire even more debt in the meantime due to the false sense of security of having sufficient funds.

The idea of retail therapy and ‘treat yo’self-culture’ is nothing new, but what sets ‘buy now, pay later’ services apart from traditional shopping and, to some extent, payday loan schemes, is how it has managed to rebrand debt into a form of self-care.

DON’T BE FOOLED INTO BAD DEBT

The concept of debt as a way of investing in your mental health is as seductive as it is warped. Klarna, PayPall and the likes are deceptive; and, unlike Wonga whose interest rate were more than 5,000% APR at one point, the danger of ‘buy now, pay later’ is more subtle.

A recent FCA report found that it’s ‘relatively easy’ to amass over £1,000 worth of debt. And, at Cobra, we can be actioned on any debt worth £1k or more, so we could quite conceivably pay you a visit in regard to a BNPL debt at some point.

Furthermore, the report also noted “the routine use of BNPL will for some users in due course lead to debts that they cannot manage.”

Tragically, the popularity of ‘buy now, pay later’ has meant a lot of people – mainly young people who are also first-time borrows – are accumulating debt in the name of self-improvement.

TRUST THE DEBT RECOVERY EXPERTS

Established in 2009, our specialist private debt recovery team are experts in their field and have seen the numerous changes and alterations to the UK payment markets including the recent popularity of ‘buy now, payer later.’

With over the 75 years’ combined experience in the industry, we know how to both recover BNPL debt, but also help anyone struggling with it.

We start by listening to you, discussing your circumstances that underpin your debt. So, if you’re struggling with ‘buy now, pay later’ debt, or are owed money and want to get it back, take decisive action and instruct Cobra today on 0151 526 4222.